(Akiit.com) When we think of crime, we often imagine a guy wearing a balaclava breaking into a home, perhaps in the middle of the night. Or maybe a man with a gun robbing a corner shop. But these are blue-collar criminals and the payouts of crimes like this are typically very small. If you want to see some truly insane thefts, you need to look to the white-collar criminals. These are the men and women dressed in designer suits who manage to steal millions, even billions from clients, other businesses and yes, the general public.

You will not believe how much has been stolen by financial professionals since 2000. And remember, these are just the ones we know about because they were caught red-handed. There are probably many more walking around living cushy lives on money that they illegally claimed. So, who are some of the world’s biggest crooks that managed to steal billions? Let’s take a walk through the financial thieves hall of fame.

Let’s start off with a fairly small fish when viewed in the relative pond, Mr Samuel Israel.

Samuel Israel

He was a hedge fund manager and opened his own hedge fund company in 1996. If you want to look at a positive here, Mr Israel proves that you don’t need a college degree to be successful, at least as a criminal. The man was responsible with his partner for looking after the funds and investments of various business owners and successfully raised 450 million for his clients.

Unfortunately, Israel used most of the profits for his own personal gain, funding a very deluxe and lavish lifestyle. Despite essentially stealing 450 million, this guy is still at the bottom of the barrel when assessing the greatest financial thefts. As we’ll soon learn, he doesn’t even come close to the level of the top dog, but that’s still more money than most people will ever know.

Israel was arrested in 2009 and sentenced to 20 years in prison and ordered to pay back three hundred million. His company is now bankrupt, and there will be very little waiting for him when he leaves prison in 2027 at the earliest.

Kenneth Lay

Kenneth Lay lost one billion for investors. This wasn’t so much a theft as it was a massive attempt to cover up a failing energy company, Enron. Lay, the then CEO used an accounting firm to cover up the failings of the business and participated in multiple accounts of fraud. He was caught after the company filed for bankruptcy in 2001 with the total losses being counted as one billion. Theses losses were felt by investors and at the time was the largest file for bankruptcy in history.

Lay never went to prison for his crimes. The man suffered a heart attack while he was awaiting sentencing. However, his acts of fraud left a lasting legacy, forcing many investors into debt. Had he not passed away, he would have received a similar sentence to Samuel Israel.

Interestingly it was a whistleblower who brought Lay down due to his financial securities fraud. Sherron Watkins worked for Enron during the fraud and wrote a detailed email to her boss, describing the situation as an elaborate hoax. Later she was named one of Time Magazine’s people of the year, highlighting just how important whistleblowers can be.

Bernie Ebbers

There is two Bernie’s on our list, and you can probably guess the second one. Ebbers lost 11 billion due to a fraud scheme to set up his company Worldcom. He built up his business through debt fund acquisitions and eventually it was revealed that he tricked investors through fraud. He claimed four billion worth of expenses and inflated profits by 11 billion through accounting errors. He was sentenced to 25 years in prison after claiming bankruptcy for his business for the sum of 11 billion. People lost their jobs, ended up in debt and investors lost millions.

Many people blame the 2008 crash on the actions of people like this who perhaps brought down the economy through serious cases of fraud. It’s interesting to point out that these crimes are simply committed due to greed. These people sought to make more money than they could ever possibly hope to spend in one lifetime.

Now let’s move on to the crown jewel of investment crimes.

Bernie Madoff

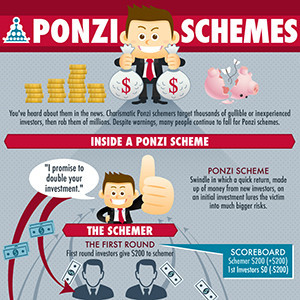

You probably know the story of Madoff. Just recently HBO actually produced a film about his incredible Crime with Robert De Niro in the starring role. The man is infamous for good reason. He successfully embezzled $65 billion over a period of two decades. How did he last for so long and just how did he manage to steal so much money. Well, the New York Investment manager set up a classic Ponzi Scheme.

It’s a fairly simple practice when you look at it carefully. To run a Ponzi scheme, you get investors to inject money into your firm. However rather than investing their money, you keep it for yourself. You then get new investors and use their money to pay the old investors and ensure they get a certain level of profit. All the while, you are keeping a wide slice of the revenue for yourself. Investors involved in Ponzi schemes focus all their efforts on attracting new people into the fold.

Unfortunately for criminals, ponzi schemes are notorious for being unstable. Eventually, they always collapse. Madoff was able to last so long because he was a trusted name. As such, he always had money pouring in from new investors. Essentially he was too big to fail.

So what did cause the Madoff empire to tumble down? When the market crashed in 2008, it brought economic uncertainty with many investors withdrawing their funds, revealing the truth behind the trick. He has been sentenced to 150 years in prison, showing just how seriously the law takes financial crimes. Committing murder will get you a lower sentence than that.

It’s insane to think about the amount of money that these financial fiends stole. We can at least be thankful that they all get caught eventually, and perhaps they should serve as a warning to business owners who believe they could successfully cheat the system.

Staff Writer; Larry Moore

Leave a Reply